Many people keep on worrying about their retirement and do not pay attention to their saving patterns. Saving with comfort can be easy but is not sustainable. You have to cut down on different things to save a good amount for your life.

Saving should start as early as possible. People who are not able to save in their young years find it difficult to sustain themselves in their retirement phase.

The knowledge of managing your money is very important. It does not come through any books. It comes by practising it every day and with experience. Knowing someone who saves effectively and learning from them is quite effective.

Saving for your retirement

There are people with lower incomes who still manage to save a good amount of money for their retirement. Retirement becomes the golden period of your life only if you are financially sound and safe. Otherwise, it can create challenges for you at that age.

Many heavy expenses occur during retirement. Medical expenses are one of the biggest ones. Most retirees often use their saved money to cater to their health conditions. Such challenging times even push you to take very bad credit loans with no guarantor from a direct lender. This puts nothing but pressure on you.

Ways to save for stress-free retirement

Having sufficient funds in your bank account will keep you tension free. Once you are free from the mind, your body responds positively to every situation.

Hence here are some ways for you to start saving effectively for a relaxed retirement.

1. Make Saving a Regular Routine

To ensure that you save every month, set up a particular date. That day, you must save money, irrespective of whatever situation you are going through.

Saving at will or in your comfort zone often leads to an irregular savings routine. It should be not by choice but by discipline. Every penny that you are putting into your savings matters. Once you are left with little money, you will understand the importance of the money saved in your younger years.

2. Be prepared

During your lifetime, keep on preparing yourself for a rainy day. You must have heard about preparing for an emergency fund. Take your retirement as your emergency fund. If you are mentally prepared, you can easily prepare yourself in terms of your finances.

3. Take aim

In your lifetime, saving should be your only goal. It does not mean cutting out on your desires and needs in your younger years. Maintain a balance between the both. You should not cut down on your desires also. This will be a short-time approach. It will not help you to save for the longer term if you are not enjoying your present.

4. Be a detective

Look for different sales and discounts that are available nearby you. Start comparing websites and look for various cashback offers. There is no harm in saving money through these discounted websites.

For instance, if you need to buy groceries, prepare a list in advance to save money later. Going to a store can often lead to impulsive spending. Another example is clothing. Do not waste money on clothes every month. Be sustainable in your approach and look for comfort rather than fashion.

5. Sleep tight

Your sleep is not equal to any amount of money. Many people go through several sleepless nights in the process of saving money. Sacrificing sleep will let you save more. This is not true.

It is important to remember that once you lose your health, it cannot be brought back with any amount of money. Try to stay healthy and then save money for your future. With bad health, you are bound to spend more money during your retirement phase.

6. Beware the inflation dragon

While saving money, consider the inflation aspect as well. Most people do not consider inflation and keep saving money according to their present interest rates.

Retirement is a future phase, and it should be calculated accordingly. Whatever you are buying should be affordable for you in the future time.

7. Ask your loved ones for help

Sometimes you may need money and do not have the required amount. Then you can turn towards your family members or loved ones for help. Take it as a debt, and do not take it as help. Your family members are there to assist you in times of need.

Another option for you is no guarantor loans from direct lenders in such need situations.

8. Manage your debt

Debt management is a crucial factor while saving money. Most people avail as much as they can. Additionally, they forget to pay off their loan or dead on time. It keeps mounting and then returns in a haunting way during retirement.

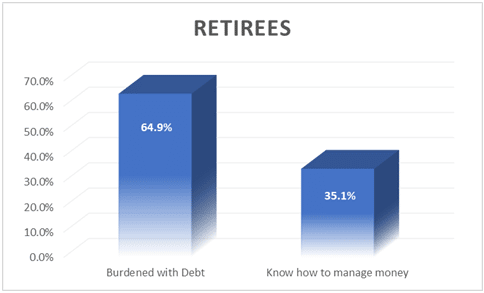

Try to manage your death during your younger years. Find out a viable solution that can help you to save more and finish off your debt efficiently. The below graph depicts the debt situation of retirees in the UK.

9. Research debt reduction options

The next step is to find debt reduction options. Do your research and search umpteen ways to help you reduce your debt. Speak to your lender and get the right guidance.

10. Stay healthy

If you stay healthy, you save a lot of money for your future. Many people start having diseases due to their anxiety about saving money. This keeps on increasing and leads to a manageable stage in their retirement.

Try to improve your health in whatever way you can. Opting for and adding physical activity to your daily routine will help you to keep a healthy body and mind.

Conclusion

Saving money is a relatively easy job. If you are moving in a balanced way, you are automatically saving a good amount of money. Follow the steps that are mentioned above. These are the right way to have a stable retirement phase. Do remember not to compromise on your present. Enjoy your present to the fullest so that you can also have a bright future.

Anna Johnson has more than 11 years of experience in direct lending industry of the UK. She is the Senior Content Editor at 24cashflow where she is leading a large team of loan experts. During her career, she has helped the loan aspirants to use the particular loans in the best way and improve their financial lives and status.

Anna Johnson is known for her in-depth research of the UK loan marketplace, as she has worked with many major lending firms in her career. During her educational phase, she has done a research on ‘Finance Fundamentals for Growing Business’.